Boost Your Business

with Capital

To

Grow

Scale

Pay Wages

Fund Operations

Renovate

Accelerate Your Business Potential with Fast, Flexible Loans from $5K to $500K. No Upfront Credit Checks.

Funding Growth at Every Stage

with possible same day funding

Taking the fuss out of business funding

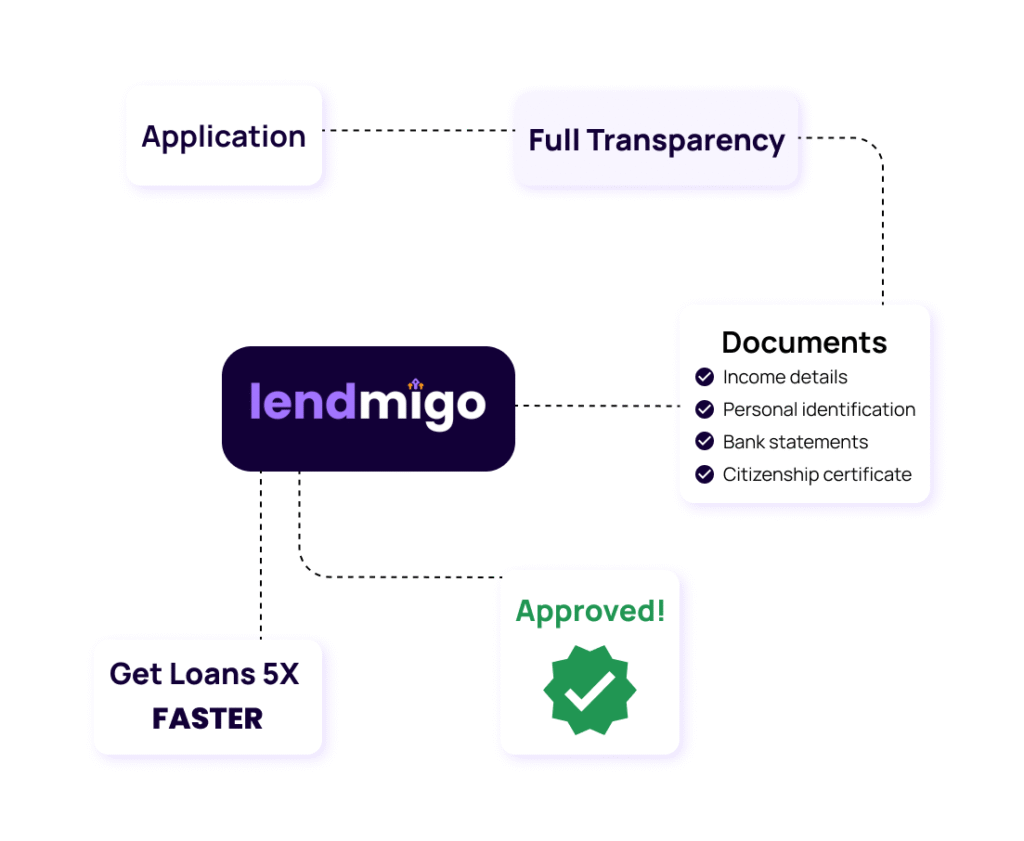

Application

Complete your online application in under 5 minutes, and we’ll have everything we need to provide an initial assessment.

Underwriting

Our loan specialists will evaluate your application swiftly. No up front credit checks required.

Approval

Upon approval, we can have the funds in your account that same day, along with a repayment plan tailored to your cash flow needs.

The Lender That Listens

Fuss Free, No Hassle

Simplified application and approval so you can focus on growing your business.

Rapid Approvals, Constant Support

Get approved in as little as 3 hours, with a dedicated loan specialist by your side.

No Impact on Your Credit Score

Receive a conditional approval without a credit check, preserving your credit rating.

Tailored Repayment Plans

Our solutions include daily or weekly repayments to match your cash flow needs.

Rewards for Early Repayment

We don't penalize you for paying back faster.

Complete Transparency

No hidden fees or surprises—just clear, straightforward terms so you know exactly what to expect.

Our Funding Solution

Rapid Business Loan

Business Growth Loan

Asset Backed Loan

Bridging Finance

Line of Credit

Why Small Businesses Trust Us Time and Again